Fashion

PhD. Martens: a brand that can keep growing

Dr Martens (DOCS) is different from the kind of IPOs that have come under criticism in recent years. Yes, the selling shareholders got a premium on their investment, but the business they sold appears to be well managed, well invested, and doing well right now.

Management has made a strong investment case for the stock, but investors must remember that this is a very fickle fashion business, and so are consumer tastes. There is no guarantee that what they like today will be more popular in the future. This makes it easy to weigh stocks and evaluate them. In this article, let’s get to know Dr. Martens with Storepc: a brand that can continue to thrive.

The Career of Dr. Martens

The company may have originated in the early 20th century, but the story of its iconic footwear begins in 1945. A recovering German soldier, Dr. Klaus Martens, designed a cushioned sole gas, attached it to a leather upper, and shared it with a mechanical engineer friend. A few years later, footwear production began. The story of the Dr Martens shoe with its distinctive leather upper, yellow stitching and air cushion began in 1960 with the release of the 1460 – a style that dominates the company’s sales today, accounting for more than 40% of annual revenue.

These boots are known for their durability and quality. Dr Martens is a brand with a broad and inclusive appeal across all ages and societies. About half of new Dr Martens buyers are under the age of 35, but the company still sells a lot of boots and shoes to people over 60 who have grown up with confidence in the brand.

These boots aren’t cheap, with an average price of £109 to £189, but they’re not too expensive either, meaning a lot of potential customers can afford them. The 1460 shoe remains the core of its Originals business, accounting for 42% of the company’s 2020 sales. The Airwair boots and footwear line makes up the company’s Originals product line, accounting for 60% of sales for the year ended March 2020.

About a quarter of their revenue comes from their Fusion brand. The rest of the company’s revenue comes from accessories such as casual shoes, children’s shoes, footwear, bags, wallets and laces, as well as work and work boots. In the past, the business relied on wholesale to other retailers, but heavily promotes direct-to-consumer sales to increase profits, but more importantly, engage with them and build brand strength.

See also: Timberland Vs Dr. Martens Which is the Best Boot? (part 1)

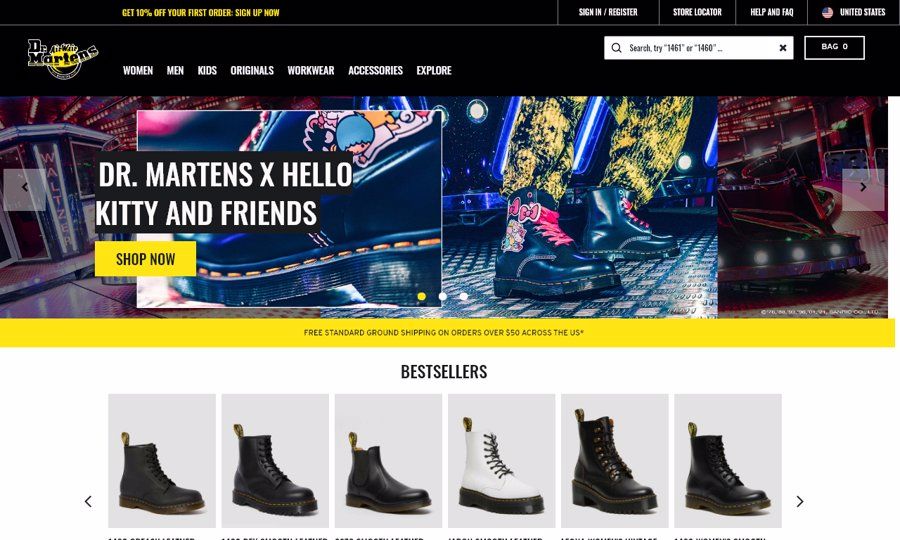

The company has opened multiple stores in major cities around the world over the past five years, and now has 130 stores, which are typically leased on short-term leases with a return on store investment of two years or less. They also offer a lot of franchises to people in markets who don’t want to open their own store. Wholesale is a faster way to market in some markets, but the company has significantly reduced the number of wholesale customers and focused on the best retailers with the same brand vision.

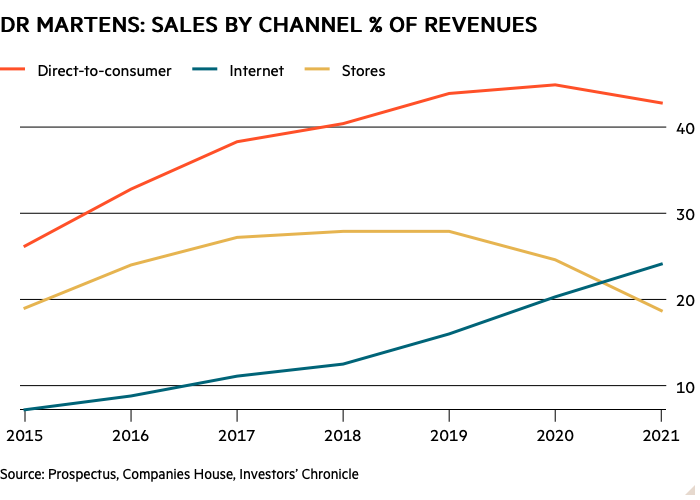

They also launched websites in key markets and significantly increased internet sales. Six years ago, they were a tiny fraction of sales, but now they are almost a quarter. Direct-to-consumer (internet and retail) sales continue to increase their share of the sales mix, with the company’s medium-term target of 60% of total revenue.

In recent years, supply chains have invested heavily in improving efficiency and providing growth capabilities. Most boots and shoes are made in Asia, but the company has reduced its reliance on China, which used to produce nearly half of its products and now only produces about a third. Production has moved to countries such as Vietnam, Thailand, Laos and Bangladesh.

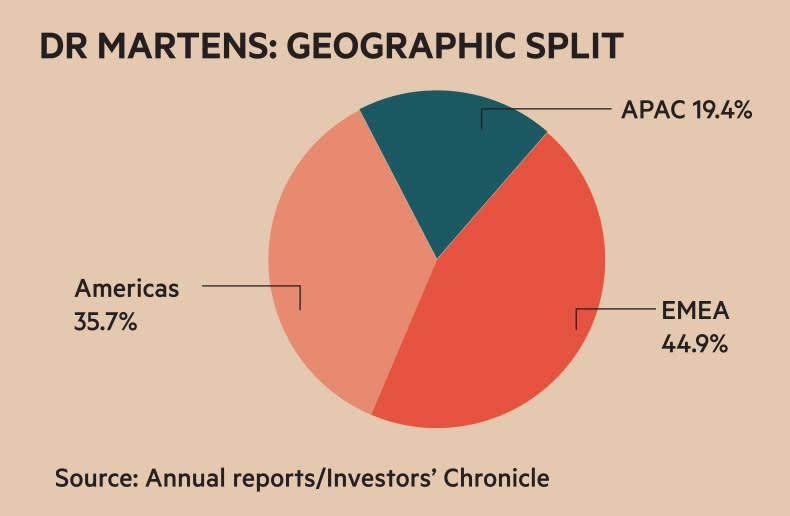

The company sold 11.8 million pairs of boots and shoes in the year to September 2020, and is building a supply chain capable of meeting demand for at least 20 million pairs a year. PhD. Martens is a global business. Their main markets are the UK, US, France, Germany, Italy, Japan and China. The company believes it is underrepresented in the Asia-Pacific region compared to its competitors and sees it as an important region to drive future growth.

Significant improvement in financial performance

Dr. Martens has had ups and downs over the years, and nearly went bankrupt in 2000. The company is in very good shape now and has been doing well since it was acquired by private equity firm Permira in 2014. The company only discloses three years of financial information in its prospectus, but its accounts can be found on the company’s website, giving investors a longer-term view of the outlook.

We can see that the company has come a long way since the acquisition of Permira. Many private companies have been accused of being cash-starved and not investing. This is definitely not the case here. Significant investments have been made in opening stores and franchising as well as in internet sales channels and improving supply chains. The results are impressive. Revenue has more than tripled since 2015, with operating profit rising from £38.7m to £171.2m in the 12 months to September 2020.

See Also: 5 Steps to Cleaning Dr.Martens at Home

The switch from wholesale to direct-to-consumer means the company makes less profit for other retailers, as seen in the sharp increase in gross margins. , resulting in higher operating margins. According to their latest financial results, the return on capital employed (ROCE) was an impressive 28.2%. Free cash flow has been mixed, but has been strong recently as profits have soared.

Earnings growth and free cash flow reduced financial distress despite higher absolute debt levels, including store rents. Based on current free cash flow, they could pay off their debt in less than 4 years if they wanted to. This is not a business to sell with huge debt.

An important thing to note about this business is the seasonality of its sales. Their peak sales period was September-December, which resulted in a sharp increase in inventory in August and September, resulting in a sharp drop in cash balances and a rise in financial liabilities to 0.5 times net liabilities. As it stands, this is a business with many high-quality business characteristics. If they have the potential for sustained profitable growth, while maintaining high margins and return on capital, they could be a very successful long-term investment given the current share price.

How will they continue to grow?

There are good reasons to think profits can continue to grow. There’s clearly a lot of momentum behind the brand, as seen from its recent revenue performance. Store expansion is expected to continue, with 20-25 new stores opening each year. With these new revenue and profit contributions, the stores opened over the past few years have matured and similar activity in existing real estate revenue can still grow significantly.

See also: The Special History Few People Know About Ph.D.Martens

It stands to reason that this has the potential to increase brand awareness and sales, especially in the Asian and Chinese markets. Dr Martens currently sells 31 boots and shoes per 1,000 people in the UK, 12 in the US and just 1 in China. If the brand’s penetration in Asia and Europe increases, the directors estimate the company will have an annual revenue of $6 billion. Achieving this goal will not be easy, and of course it will take several years if it is to be achieved.

Its success depends on brands staying relevant to consumers in a highly competitive market. Brand awareness is also important. Expensive boots made in cheap manufacturing countries make the practice risky, but not unlike what most of the world’s top fashion brands do. There are many knockoffs of Dr Martens on the market, but the general consensus seems to be that this shoe is still a good choice.

In addition to revenue growth, there is a lot of self-service that can improve a company’s bottom line. Continuing the shift to direct-to-consumer sales is still some way off, and hopefully margins will still improve. Cost savings from supply chain investments also help here. The company is very optimistic about its prospects for the next few years. It expects a big jump in sales to drive sales – 14% to 15% in the year to March 2021, with youth income growing at a high rate in 2022. Margins are expected to improve as profits grow faster than revenue and debt levels fall.

This is an introductory article on Ph.D. Martens: A brand that can continue to thrive. Stay tuned to Storepc for updates on the latest fashion trends and Sneaker footwear news.

See more:

PhD. Martens x Marc Jacobs’ Best Investing Boots This Winter

Dr. Martens launches first Keith Haring collection in near future